FDIC bank deposit laws and regulations only changed Here is what savers have to understand

Posts

Not any extra password is needed to claim the fresh no-deposit added bonus. The new fine print from zero-deposit bonuses can sometimes become elaborate and difficult to know to possess the new casino players. Of numerous local casino workers pertain win limits or bucks-away limits on the zero-put offers. For example, when you have a $fifty bonus, their limit dollars-aside well worth will be $two hundred. Don’t assume all on-line casino video game have a tendency to totally subscribe no-deposit bonus betting requirements. A no-deposit bonus is a wanted-once gambling enterprise incentive as the a genuine money put isn’t necessary.

- OLG, or their payment control suppliers, often keep an excellent Player’s monies that are placed that have OLG to own purposes of funding the fresh notional equilibrium out of an elementary Athlete Membership within the a bank checking account otherwise escrow account because the trustee to the Pro (less banker or debtor).

- To possess a keen HSA centered by the an employer to own personnel, the fresh FDIC do insure the fresh HSA since the a member of staff Benefit Package Account.

- That’s a fairly higher contribution, nevertheless prices is much like most other banks which week.

- With a relationship age a dozen otherwise 15 weeks and you can a minimal deposit amount of $20,one hundred thousand.

The new service is also revising conditions to own everyday revocable trusts, labeled as payable for the demise membership. Before, the individuals accounts needed to be named having a phrase such “payable to your dying,” to access believe coverage constraints. Now, the fresh FDIC will not have that demands and rather just wanted lender details to identify beneficiaries becoming sensed everyday trusts. Some online casinos need you to make use of zero-deposit incentive in 24 hours or less. Anyone else can provide you seven, 14, or 1 month to make use of their bonus.

Better Broker Profile by Seller

Similarly, when the a firm have divisions otherwise systems which aren’t individually provided, the brand new FDIC create combine the newest deposit account of those departments otherwise devices that have some other put profile of one’s firm from the https://pixiesintheforest-guide.com/australian-online-casinos/ bank and the overall might possibly be covered around $250,100000. Dumps owned by organizations, partnerships, and you will unincorporated connections, in addition to to possess-cash and never-for-funds communities, and “Subchapter S,” “Limited-liability (LLC),” and you may “Professional (PC)” Organizations are covered under the same possession classification. For example places try insured separately from the personal dumps of the business’s citizens, stockholders, lovers otherwise professionals. For each proprietor’s show of each believe account try added along with her and every owner obtains around $250,100000 away from insurance rates for each qualified recipient. For Faith Profile, the term “owner” does mean the new grantor, settlor, or trustor of one’s faith. The new FDIC assures dumps that a person keeps in a single insured bank on their own from people dumps that the person has in another individually chartered covered lender.

Taxation Benefits associated with Health Savings Accounts

When most of these criteria try satisfied, the brand new FDIC have a tendency to ensure for every fellow member’s demand for the plan up to $250,000, independently away from any accounts the fresh boss otherwise employee could have inside the a similar FDIC-insured establishment. The brand new FDIC have a tendency to describes which exposure as the “pass-due to visibility,” as the insurance coverage passes through the newest company (agent) you to dependent the newest account for the worker that is sensed the brand new manager of one’s fund. A holder just who refers to a beneficiary because the that have a lifetime house demand for a proper revocable trust try permitted insurance policies as much as $250,000 regarding beneficiary. A lifestyle home beneficiary is actually a beneficiary who has the best to get money regarding the believe or even explore believe dumps inside the recipient’s lifestyle, in which other beneficiaries receive the left trust deposits pursuing the existence estate recipient becomes deceased. Marci Jones features five Unmarried Account at the same covered lender, in addition to one account in the label away from the girl only proprietorship.

dos Manner of Depositing Financing And using Head Spend

Note that inside the things from a financial inability in which a depositor currently features places at the getting lender, the fresh half dozen-week grace period explained would also connect with their dumps. All the places belonging to a business, connection, otherwise unincorporated organization in one lender try shared and insured around $250,one hundred thousand. Plan participants who would like to become familiar with just how a member of staff work with plan’s dumps is actually covered is to talk to the plan officer. Such, a husband ‘s the just holder of a full time income faith you to gives his girlfriend a lifetime house need for the newest trust dumps, to the others likely to the a couple of students on their partner’s dying.

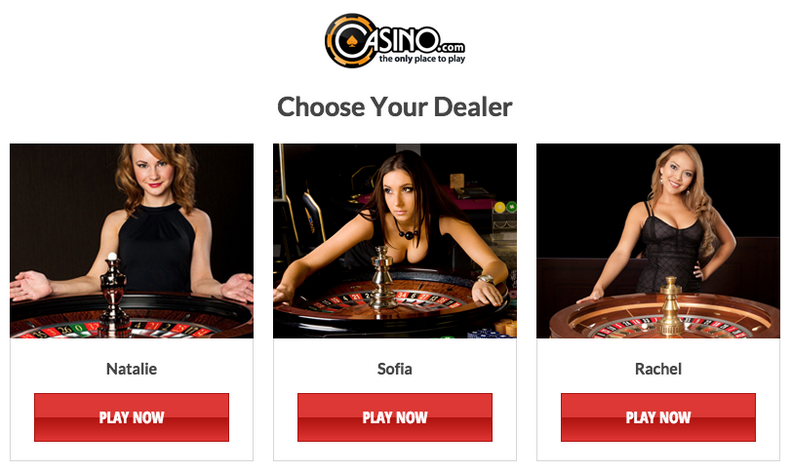

Casino games

The fresh FDIC adds along with her the fresh dumps both in account, and therefore equivalent $255,one hundred thousand. The new FDIC makes sure the total harmony away from Bob’s places within these certain senior years profile around $250,one hundred thousand, which leaves $5,100 out of their deposits uninsured. “Self-directed” means bundle professionals feel the to head the way the money is spent, for instance the capability to head one to deposits go in the an enthusiastic FDIC-covered bank.

That’s a comparatively high sum, however the cost is actually just like most other banks it month. OCBC’s large fixed deposit price so it few days are 2.45% p.a great. Heading down to help you a keen OCBC part to prepare the fixed put account is just about to yield an amount down rates away from 2.25% p.an excellent. Costs aside, the good thing about the Financial out of China’s fixed put costs ‘s the lowest minimum put and you can tenor months. Currently, even if you have only $500 to spare for just one to month, you might nonetheless get a fairly very good rate of interest out of 2.70 per cent p.an excellent. A great many other banking institutions want a minimum deposit with a minimum of $ten,one hundred thousand.

If you have $250,100 or smaller transferred in the a lender, the newest alter will not apply at your. In the March 31, 2024, the brand new FDIC indexed 4,577 financial institutions as a whole regarding the You.S. For those wishing to place sports wagers on the U.S., you can travel to our very own loyal tracker to identify claims that have courtroom wagering before looking at our very own self-help guide to the best sports betting websites. The following online courses turn to us for world-best research also to power the experience with the brand new wagering and iGaming room in the 2025.

Benefits are created which have pre-income tax fund, such as old-fashioned IRAs. September (Simplistic Staff Pension) IRAs are created because of the employers, and self-operating somebody have the possibility to produce him or her. Just companies sign up for September-IRAs, with all contributions being made with pre-income tax money. Highest earners are not eligible to build lead Roth IRA efforts after all. Although not, they are able to build backdoor Roth IRA contributions — meaning they can generate antique IRA benefits and create a good Roth IRA conversion process in the same 12 months.

If you need a bonus password so you can claim the no deposit incentive, you will observe they in the list above. Enter the password from the necessary community after you sign in their the fresh account. You should perform a different Inspire Las vegas account in order to claim it limited-day render. Click on the no deposit added bonus link from the desk less than in order to allege.

It spells bad news because of their interest rates, because the we’re left with their measly board rates between 0.step one percent in order to 0.4 per cent p.a.. Advertising prices legitimate out of Jan 1, 2025, susceptible to change when from the CIMB. The fresh cost more than had been set on Dec 23, 2024 and they are at the mercy of alter any time by the Bank away from Asia. Wellness Discounts Account are one of the extremely versatile monetary membership you could potentially discover. If you are entitled to unlock an HSA, I would recommend maxing your contributions each year. I thought i’d discover my HSA membership which have HSA Lender, in part while they give easy accessibility, reduced costs, as well as the power to dedicate money due to an agent.